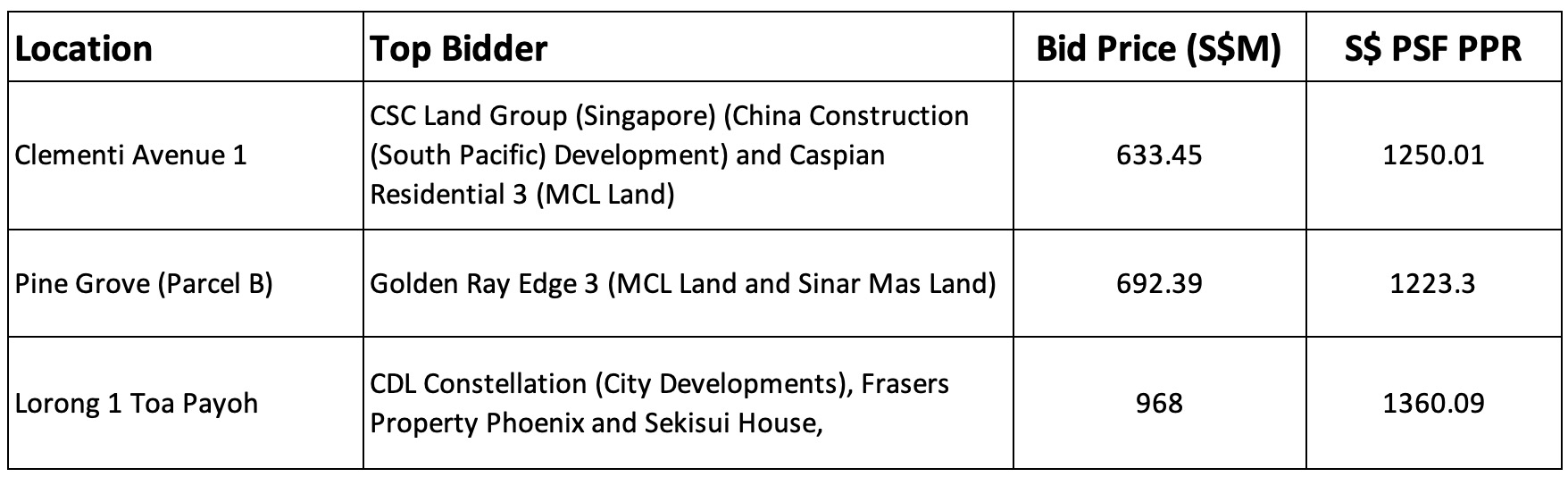

1360 psf ppr, why developers are so bullish?

Summary for tenders closing on 7 Nov 2023 - URA

“Mogul.sg chief research officer Nicholas Mak estimated the future launch prices of the residential projects that would be developed on each of the land parcels could start from S$2,300 psf for the project at Pine Grove (Parcel B), to as high as $2,550 psf for the project in Lorong 1 Toa Payoh.” Business Times

The prices at RCR are possibly heading towards $3000 psf. Why developers are so bullish? Here are possibly 3 reasons.

- Price going up but pipeline supply at around historical low

- Population is surging at record rates

- Muted en-bloc sales market

Let’s look at them in detail.

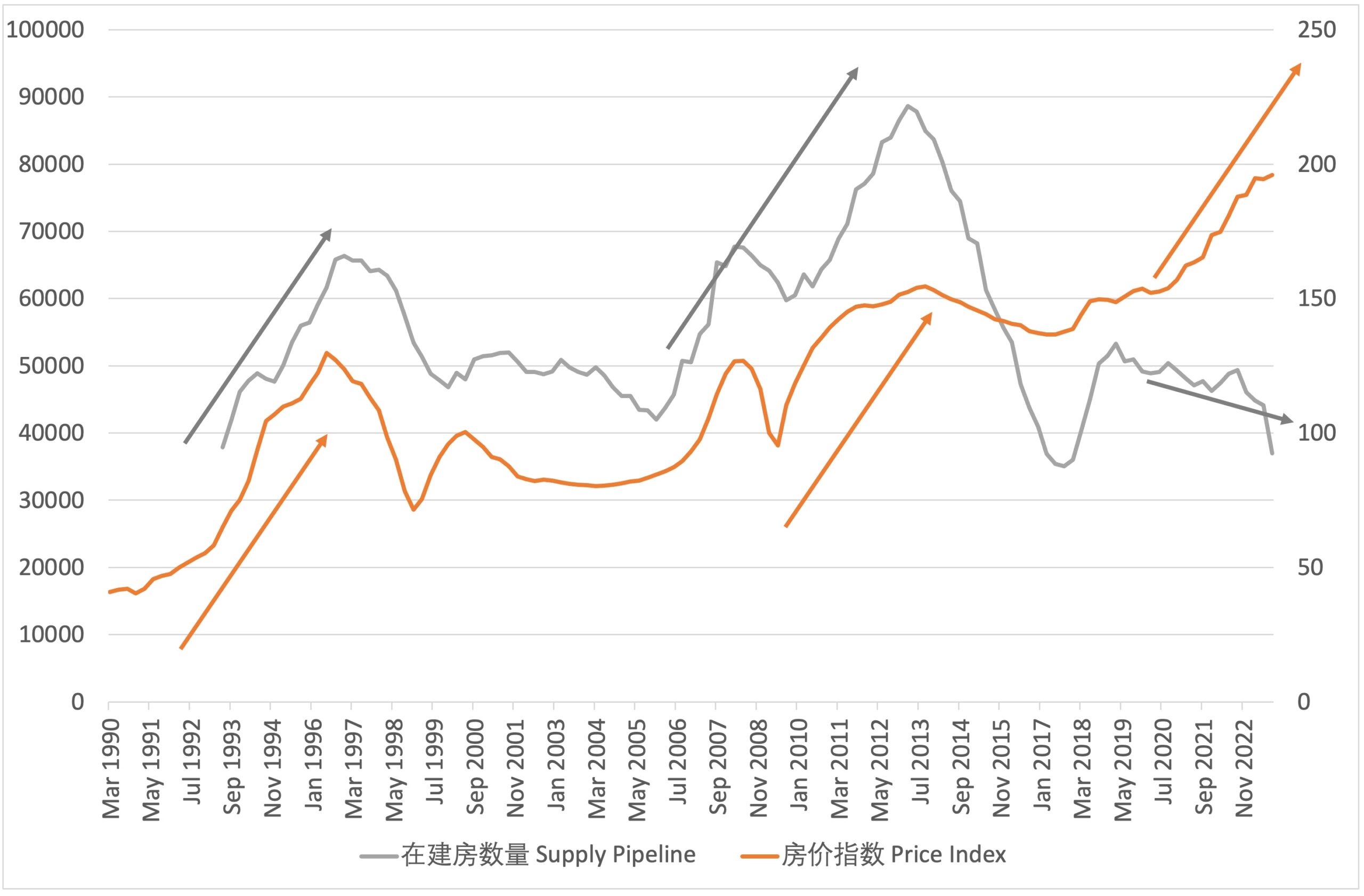

1. Price going up but pipeline supply at around historical low

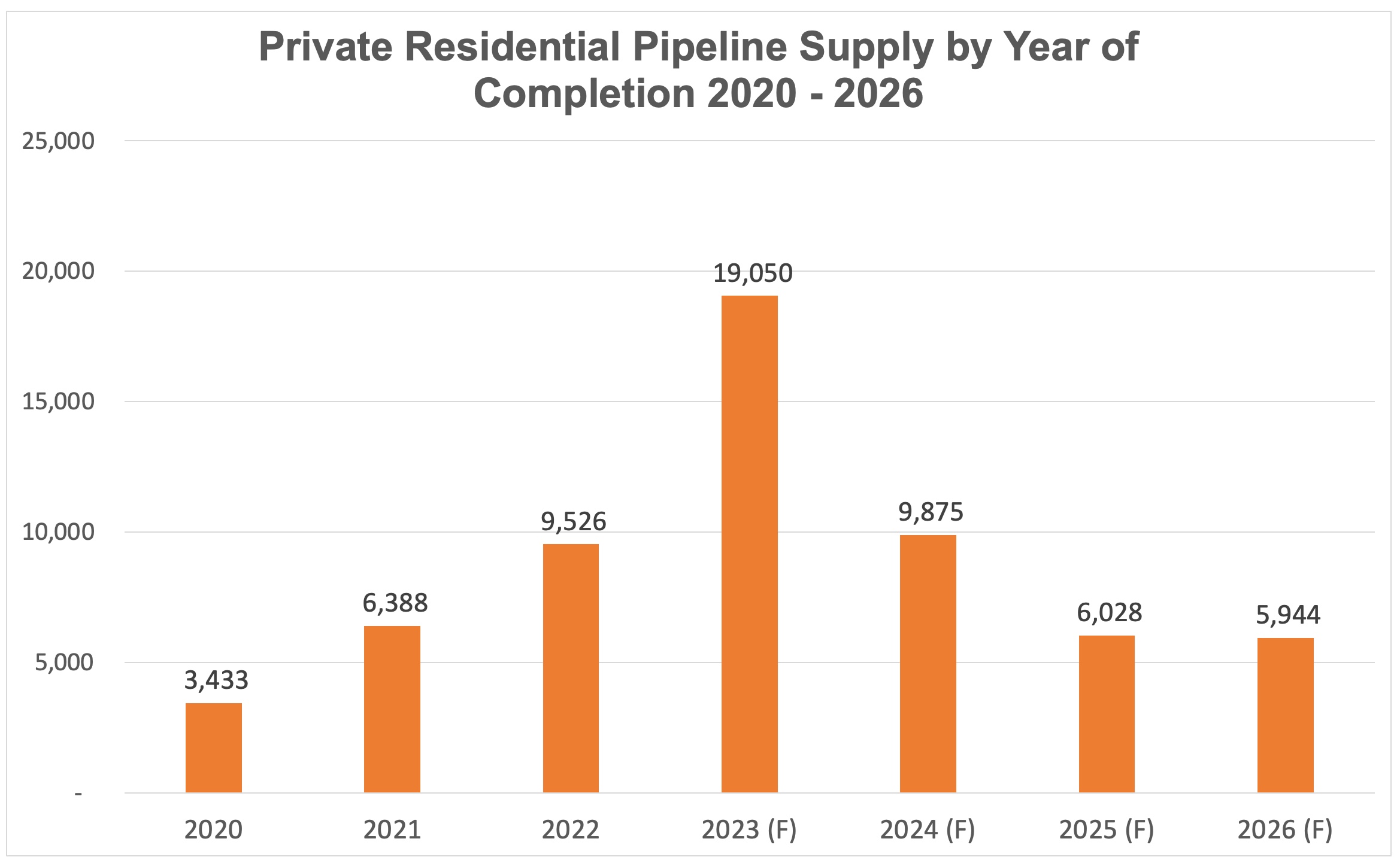

The chart below indicates potential shortage in supply in 2025, even though there is substantial number of properties obtained T.O.P. this year.

There may be a temporary excess in supply in 2023-2024. However, it is likely short-live in view of the surging population, which is the 2nd factor that we will discuss.

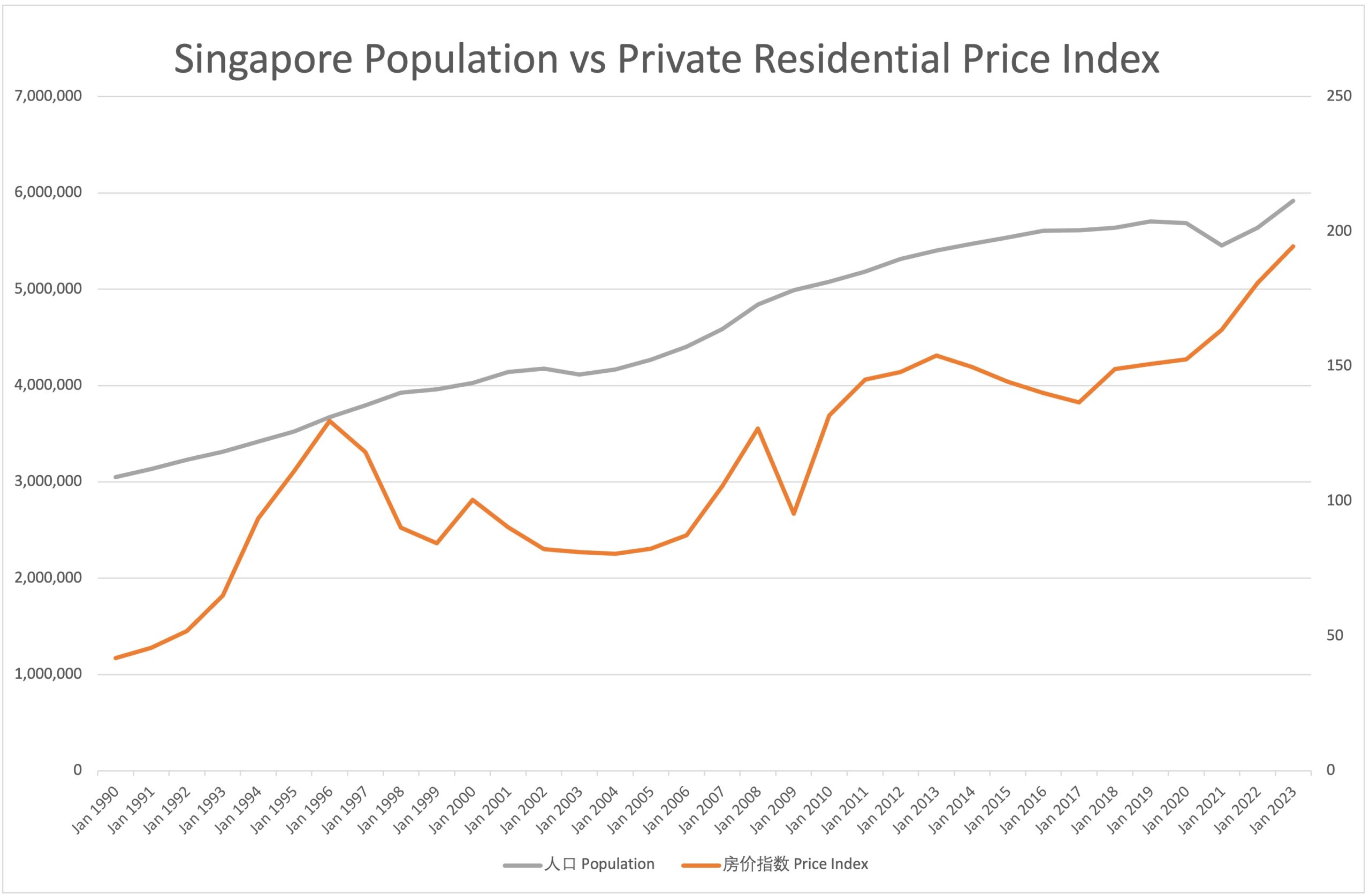

2. Population is surging at record rate

Singapore population is surging rapidly, up 3.4% and 5.0% in 2022 and 2023 respectively.

Naturally demand is higher. Based on the average of about 4 pax per household. The population increase in 2022 and 2023 will need approximately 116,000 properties. Assuming 20% stay in private property, that is 23,200 units.

Though there are some excess, it isn’t a lot to have a material effect, especially if the population continues to grow at record rates.

Population and property price seems closely related. When population is growing fast, price also appreciating rapidly, as witness in early 1990s, post SARS (2005-2008) and post Covid (2022-2023).

3. Muted en-bloc sales market

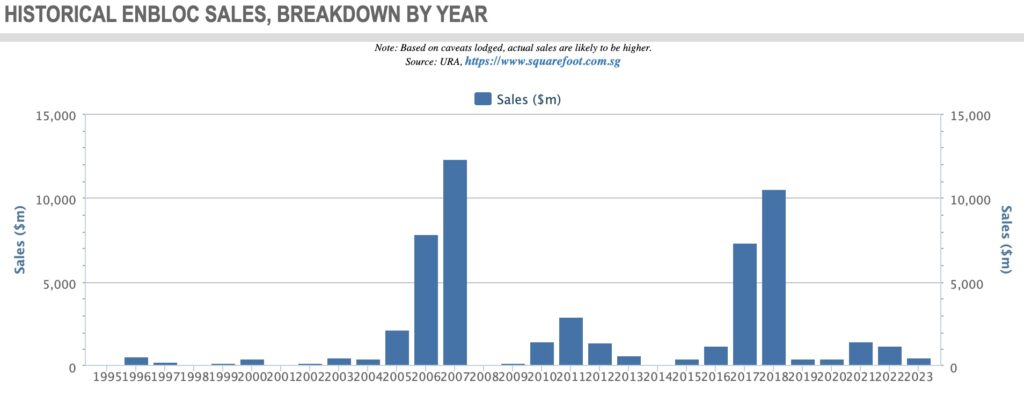

In the past, when price is up there is always a flurry of en-bloc sales, as witness in 2006-2007, 2010-2012, 2017-2018. However, the market is muted lately. The high ABSD environment is deterring developers, foreigner owners and multiple property owners from going for en-bloc sales.

Lack of en-bloc sales further reduces supply and contributed to the developer’s bullish sentiment.

References

https://www.businesstimes.com.sg/property/mcl-land-jvs-top-bids-clementi-pine-grove-plots-ura-tender

[EDGEPROP] MCL Land and CSC Land JV submit highest bid of $1,250 psf ppr for Clementi Avenue 1 GLS site

https://www.edgeprop.sg/property-news/clementi-avenue-1-gls-site-receives-six-bids-highest-bid-1250-psf-ppr